Best rated money counter machine manufacturer and supplier? Front- vs. Back-Loading Machines: Both types of machines feature loading hoppers on the top of the machine. The difference between front- and back-loading machines is the orientation of how bills are placed in the hopper. A front-loading machine requires the bills be placed into the hopper in a horizontal stack (i.e. placed flat face-up or face-down). Bills are placed into the hopper of a back-loading machine in a vertical stack (i.e. face-forward on its side). Front-loading machines offer the benefit of being able to add bills while the machine is counting which speeds up the counting process. Back-loading bill counters must first completely cycle through a stack before more bills can be added to the hopper. Read more info on currency counter.

What can money counter Ribao BC-55 help to solve? Ribao BC-55 is undoubtedly the best money counter machine that can be used for complex processes in government agencies without any hassles. Not only is this machine extremely easy to use, but it also completely eliminates the need for human involvement, eventually eliminating the chances of errors. Besides counting bills, this advanced machine can print or upload the banknote counting data to the computer so that people associated with government agencies can easily generate Excel tables. It is highly convenient for data management. This machine is developed while keeping in mind all the requirements and expectations so that it can meet the standards of an advanced and the best cash counter machine.

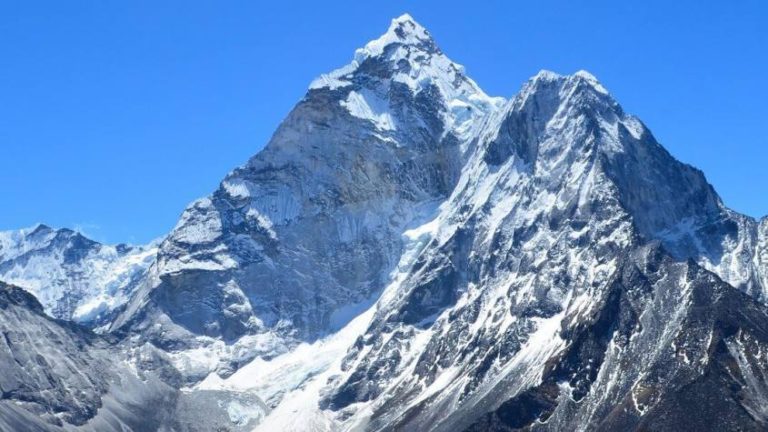

UnionPay Japan conducted an online questionnaire survey to understand how many people are using cashless payments in the recent scenario, and the survey was conducted from April to May this year. 300 male and female respondents aged 20 to 60 in Japan, China and South Korea took part in this survey. According to the results, the monthly per capita cash use in China is something around 2,848 yen. In South Korea, it is around 9,640 yen; in Japan, it is around 20,633 yen. This picture shows the transaction preferences of people in these countries. Tourists love QR code payments or cashless payments while traveling as it becomes a little complicated and risky to travel with a lot of cash. Converting one currency into another is still hazardous. So, it can be said that the preferences of transaction methods of several countries also can affect the economy of those countries in the future. According to another group of financial analysts, these differences in preference can also affect the share market in some way or another. We hope that country and economic heads will be able to deal with this situation precisely.

Counting the number on the cash register : If you are counting the number on the cash register, you are actually ensuring that you have received the exact amount right from the register. However, what to do if you entered the wrong amount incorrectly, right at the beginning? Then the displayed amount on your cash counter will be wrong as well, which means you will also return the wrong change amount to the customer. This method reduces the chances of ending up with the wrong deal. For instance, the total sales amount is $8.64, and the customer handed you a $10 bill. Now you do not need to have an idea of what the change should be, i.e., you do not have to do any subtraction to understand the total due. All you must do is start counting up from the sales amount, i.e., $8.64.

Technological advancements have led to the development of new methods of counting money. It is presently possible to transfer money via electronic forms like online money transfer portals. For instance, you can send or pay money for goods and services via your credit card or mobile phone. In addition, it is also possible to send money to one’s bank account or even withdraw the same electronically. With time, more and more businesses are now adhering to this electronic mode of payment. For instance, online stores can effectively operate via electronic payment techniques like credit cards, direct bank transfers, or online money software like Mastercard and PayPal.

All the documentation processes handled by government agencies are extremely important and so the payment related to those processes. That’s why the agencies need to be extremely careful about cash handling. On the other hand, it is known to all how counterfeit money has become a threat to everyone, especially in the United States. That’s why government agencies need to give special attention to the cash debited by the citizens. If it is done manually, it will not only be a time-consuming process, but also there will be chances of errors that can harm a citizen in several ways. Discover additional information at https://www.amazon.com/RIBAO-Denomination-Professional-Effective-Counterfeit/dp/B08HMQT31J.